- Help Center

- Payroll

- Special Tax Settings

-

Global

-

Affordable Care Act (ACA)

-

Human Resources (HR)

-

Payroll

-

Time & Labor Management (TLM)

-

Tax Agency Management

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia - Washington D.C.

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Review New Jersey Tax Rates

How to translate the New Jersey tax codes on your rate notice vs. how they calculate in the payroll system.

Overview

New Jersey has different unemployment and disability rates, some assigned by the state to everyone and some specific to your organization. This article will review how to distinguish the different rates on the agency website and your rate notices and find those tax calculations in the payroll system.

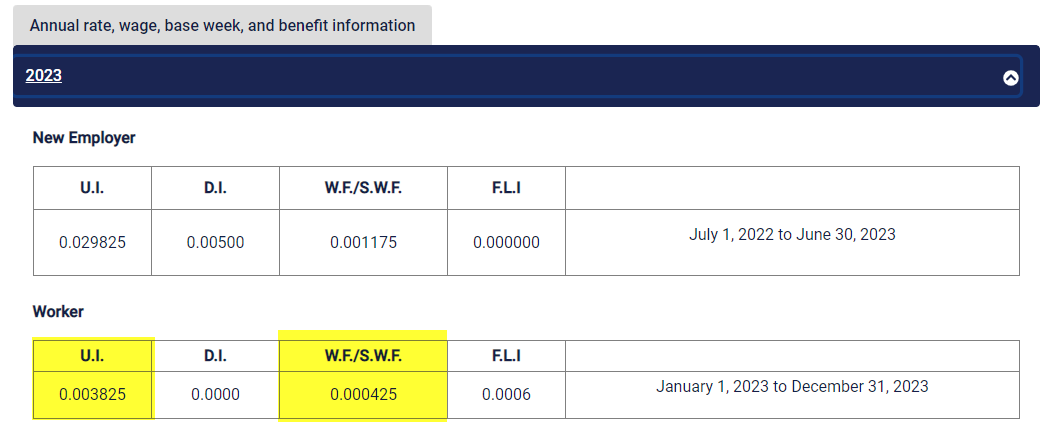

On the New Jersey website, you can see the different rate types that will be assigned. This chart is updated each year with agency defaults and new employer rates.

January for Employee Rate Updates

The worker/employee taxes are updated in January each year and match the following tax codes in the payroll system. These are agency-based rates.

- The Tax Code named EE New Jersey SUI will tie to the following tax codes on this chart:

- The Tax Code named New Jersey SDI (employee calculations) ties to the following code on this chart:

- The Tax Code named NJ FLI ties to the following code on this chart:

July for Employer Rate Updates

The employer tax rates are updated in July each year and match up to the following tax codes in the payroll system.

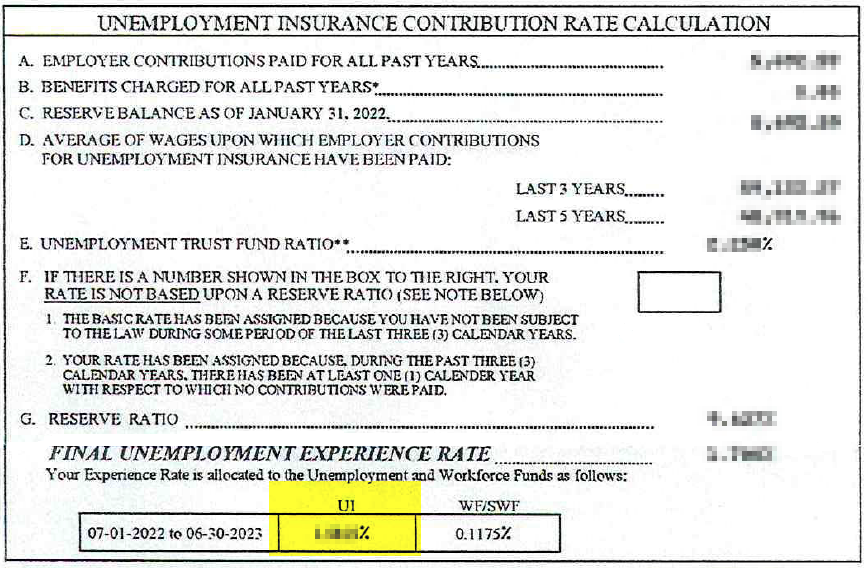

- The Tax Code named ER SUTA New Jersey is an employer-specific rate and will tie to this area on your rate notice received from the agency:

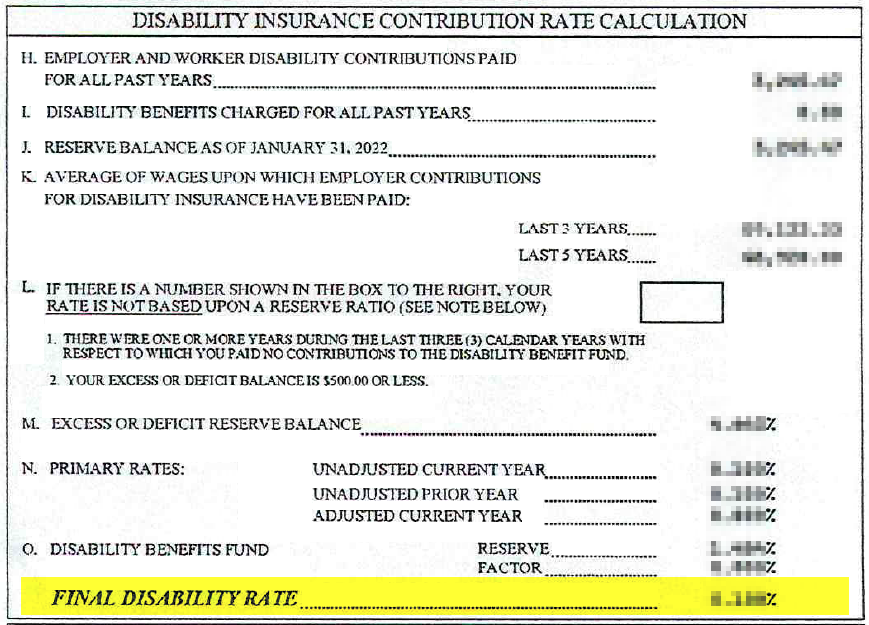

- The Tax Code named New Jersey SDI (employer calculations) is an employer-specific rate and will tie to this area on your rate notice received from the agency:

- The Tax Code named NJ Work Force Development/Supplemental Work Force ties to the following code from the agency website chart. This rate is also shown on your rate notice, next to UI, named WF/SWF: