- Help Center

- Payroll

- General Ledger

-

Global

-

Affordable Care Act (ACA)

-

Human Resources (HR)

-

Payroll

-

Time & Labor Management (TLM)

-

Tax Agency Management

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia - Washington D.C.

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

General Ledger Debit & Credit Showing on the Same Row

General Ledger reports may sometimes show a debit and a credit value in the same row that your accounting software may not appreciate. This article will go over why this happens and how to fix it.

How does this happen?

This normally happens because of a negative amount entered on payroll, either as a one time override or a voided check.

When we have a negative regular earning, for example, the system would either use that as a negative DEBIT on your regular earning row, or it would change that negative to a positive CREDIT to move it to the other side of your accounting.

How do we fix it?

- Go to My Reports > Payroll Reports > Post Payroll Reporting > General Ledger (Summary)

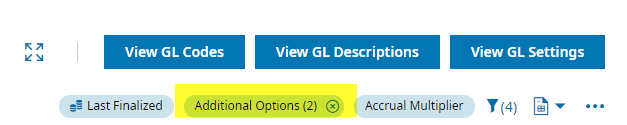

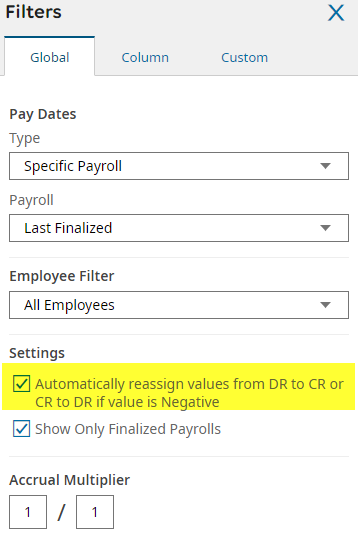

- Click on the Additional Options Filter on the top right

- Remove the checkbox next to the "Automatically reassign values" checkbox

- Click Apply to review your updated General Ledger Report, and save if necessary