Direct Deposit Fraud Prevention and data security is a high priority of every employer. This article will go over updates to NACHA mandated pre-note rules.

Overview

The National Automated Clearing House Association (NACHA) is an independent organization that operatates the ACH network that is used for processing employee direct deposits. In 2022 and 2023, they updated the rules regarding the usage of pre-notes (also known as "micro-entries"). You can read more about NACHA and their new rules on their website.

Fraud Prevention With or Without Pre-notes

With or without pre-notes, fraud prevention and data security should be the priority of any employer. Your employees should log into the Fuse system and submit their data electronically and safely for any updates to their information.

If you currently accept direct deposit and banking information in any way that is not through an HR Action in the Fuse system, don't hesitate to contact support@fuseworkforce.com to discuss a better way to manage your data.

Please review the risks associated with direct deposit fraud.

Pre-note Policy

While NACHA does not require that pre-notes are used for fraud prevention, they do require that if you do use pre-notes, you must wait at least 3 banking days after sending that pre-note before sending any live direct deposits to that same bank account.

How Pre-Notes Work

- Once a new direct deposit is saved, the pre-note status will show as Ready to Send.

- Every business day at 5 pm EST, Fuse will generate pre-note files for transmission. The pre-note status will change to Sent.

- Five days later, the pre-note status will automatically change from Sent to Expired, and the bank account will be ready for use in payroll

If at any point in the above process, you cancel a pre-note, it is your responsibility to make sure that the 3 banking days have passed before using that direct deposit. If 3 days have not passed, Kotapay will automatically reject the direct deposit on that bank account using a R97 xcelerated return that will incur additional charges and require you to pay your staff internally.

Fuse will no longer be manually removing or voiding pre-notes between saving and sending.

Removing Pre-note Functionality

NACHA does not require pre-notes be sent, so you have the option of disabling them from the Fuse system completely.

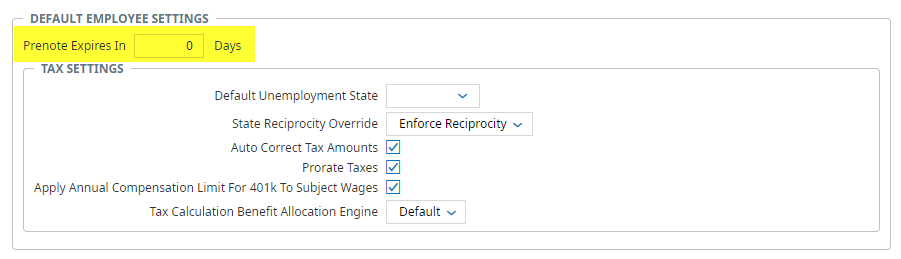

- Go to Settings > Global Setup > Company Setup

- Go to the Payroll Tab

- In the Payroll Settings widget, update your Prenote Expiration to zero days

Once this is enabled, the system will no longer generate pre-note files or place any direct deposits on hold. This will only affect direct deposits added after this change is made.