At the end of 2017, the IRS began sending Letter 226J to Applicable Large Employers (ALEs) as a proposed assessment of Employer Shared Responsibility Payments (ESRPs) under the Affordable Care Act. If the IRS determines one or more full-time equivalent employees enrolled to receive health care coverage on a government exchange and received a premium tax credit/federal premium subsidy, they will send this proposed assessment letter to the employer. This is the first step in the process to enforce ESRP requirements under the ACA.

In simple terms, if you’re an ALE and the IRS has reason to believe you were noncompliant with the employer mandate of the ACA, they’ll send you a letter to tell you how much money you owe for violating the mandate. You have to respond to the IRS saying whether you agree or disagree by the response date stated on the letter.

But as with most anything government-related, it’s more complicated than that. Let’s dive into some important questions employers have about Letter 226J so you can be prepared if a letter arrives in your mailbox.

What employers should expect in Letter 226J

This letter serves to notify employers of proposed assessment of liability (how much money the IRS believes you owe them). Along with the notification, the letter will also include:

- an ESRP summary table that itemizes your proposed ESRP by month.

- a list of any full-time equivalent employees who received a premium tax credit for health care coverage on the government exchange.

- Form 14764: ESRP Response (complete and return to the IRS by the response date).

- Form 14765: Employee Premium Tax Credit (PTC) Listing.

A Penalty and B Penalty: How liabilities are assessed

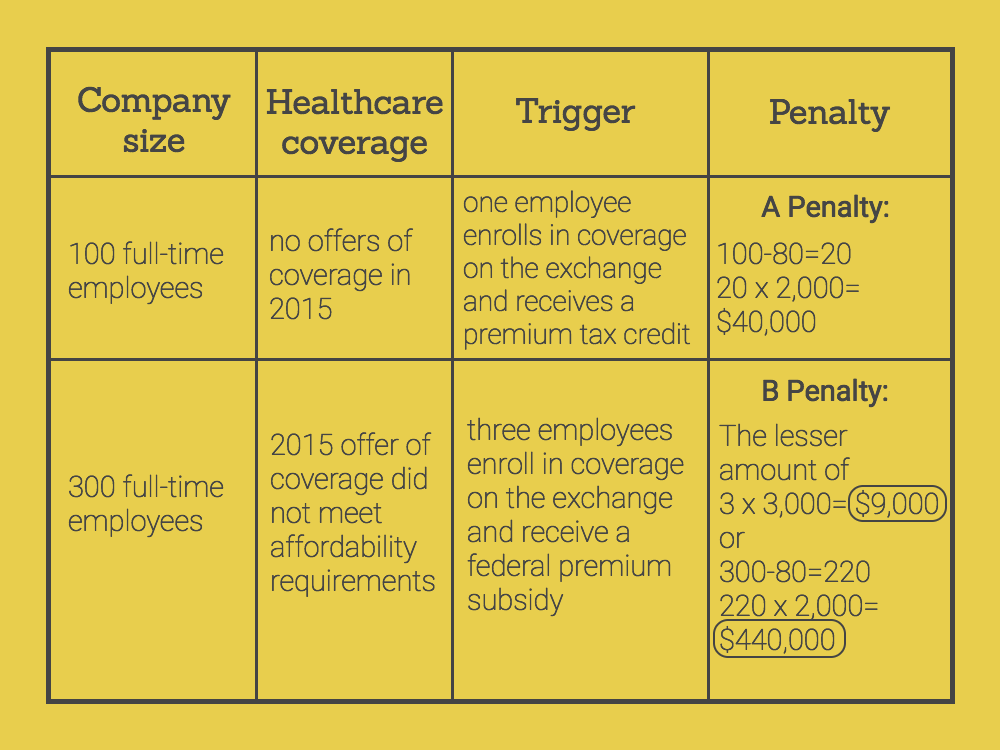

According to the ACA, there are two types of penalties an employer may violate and receive Letter 226J: “A penalty” and “B penalty.” This will determine how much employers will owe the IRS. The penalties are calculated monthly and paid annually.

If an employer fails to offer healthcare coverage to at least 95% of employees (70% in 2015), the employer violates the A penalty. The A Penalty triggers if one or more full-time employees receive healthcare through the exchange and a premium tax credit because the employer made no offers of coverage. This penalty will cost employers $2,000/ full-time employee, excluding the first 30 employees, annually.

If an employer fails to make an offer of healthcare coverage that meets the minimum value and affordability requirements, the employer violates the B penalty. The B penalty triggers if one or more full-time employees receive healthcare through the exchange and a federal premium subsidy because the employer made an offer of coverage that was not affordable or did not meet the minimum value requirements. This penalty will cost employers either $3,000/full-time employee who receives a federal subsidy or the A penalty cost ($2,000/full-time employee) annually—whichever amount is less.

But wait—I thought I was ACA compliant! Why am I receiving this letter?

This letter may come as a surprise for many employers. You may have thought you properly managed ACA compliance, or you may have expected the liability to be much lower than it is. If you received Letter 226J from the IRS, it does not mean the IRS has determined your organization as noncompliant with the employer mandate. The letter acts a proposed assessment of liability, meaning that at least one of your full-time employees enrolled in health care coverage from a government exchange. Prior to sending the letters, the IRS does not investigate employers whose employees receive a premium tax credit. They send the letter based on the fact that a full-time employee did receive a premium tax credit. It’s possible that an employee incorrectly stated their qualification for healthcare coverage on the exchange and a premium tax credit.

With that, the IRS asks all employers who receive the letter to give a response on whether they agree or disagree with the proposed assessment. If you do not respond to the proposed assessment within the response period, the IRS will assume agreement. Then, the IRS will issue a notice and demand for payment, and interest will begin to accrue on the amount owed.

Employers who agree with the proposed assessment:

If you agree with the IRS’ proposed assessment, sign Form 14764 (enclosed in the letter), and send payment to the IRS within the 30-day response period.

Employers who disagree with the proposed assessment:

First, you want to be sure to have all relevant records from 2015 enrollment and payroll handy. This will be useful when reviewing your Forms 1094-C and 1095-C filed in 2016 for the 2015 tax year. You need to verify you submitted these forms without errors. If you do find errors on these forms, you will need to complete Form 14765, the Employee Premium Tax Credit Listing (you do not need to re-submit corrected Forms 1094-C or 1095-C). Next, complete Form 14764 and a signed statement on why you disagree with the proposed assessment, including any supporting documents like the Form 14765. There will be an opportunity later in the process for you to request a pre-assessment conference with the IRS Office of Appeals. You may also request an extension from the IRS if you need more time to review your 2015 ACA compliance.

Don’t wait until it’s too late to get your ACA compliance in order in 2018. Get the software that lets you proactively manage ACA compliance across your entire workforce. Fuse Workforce’s ACA compliance module is the only solution delivered on the power of a single platform for HR, benefits administration, time and attendance, and payroll. Not sure if your ACA compliance management meets the IRS standards? Get a free assessment from one of our ACA specialists.